Canada Emergency Wage Subsidy (CEWS)

- Apr 27, 2020

- 2 min read

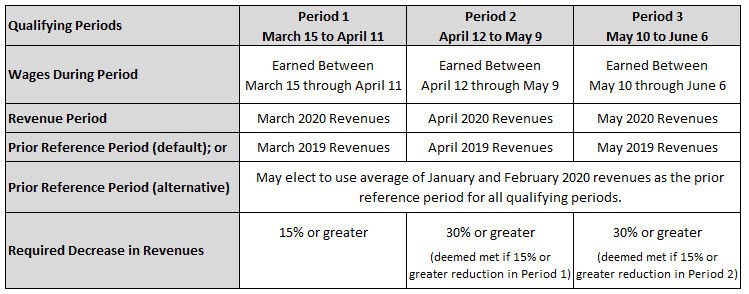

The Federal Government recently announced that applications for the Canada Emergency Wage Subsidy (CEWS) will open on Monday, April 27,2020. CRA has provided additional information with respect to the CEWS, including answers to some frequently asked questions.

Note: For the purposes of the CEWS calculations, companies can utilize either the accrual method or cash method of accounting, provided that it is consistently applied.

The application process will open on Monday, April 27, 2020. For complete applications that pass through Canada Revenue Agency's (CRA) system validations, a payment will be issued automatically, though some applications may be selected for a pre-claim review. Generally you can expect to receive your payment within 10 business days as long as you are registered for direct deposit on your payroll account.

The CRA will use a combination of automated queries and validation within its data (i.e. historical payroll filings), follow up phone calls to verify certain elements of the claim if necessary, and more comprehensive post-payment reviews or audits.

How to Apply for CEWS

Applications for the CEWS will be accepted through CRA My Business Account. The CEWS will be processed at the payroll program (RP) account level and separate applications will be required for each RP account. Wage subsidy applications must be made before October 2020.

Calculating Your Subsidy Amount Prior to applying for the CEWS, eligible entities should determine the subsidy amount to which they are entitled. The CRA has launched an online calculator to assist businesses with the calculation and simplify the application process. The CEWS amount for a business is based on the number and type of eligible employees, and the amount and type of pay they received before and during the crisis. Determining the subsidy amount should be done before accessing the online application.

Notes

Documentation to support the wage subsidy claimed should be maintained and made available to the CRA upon request. CRA has indicated that this documentation should include an analysis of the nature of the remuneration. It should be evidenced that dividends and other ineligible remuneration has been removed from the calculation.

A signed attestation, and record of any elections made for the purposes of determining the qualifying revenue, must be maintained and made available to the CRA upon request.

Comments